Blog: Million Dollar Case Study: Amazon Tax & Legal Structures

Million Dollar Case Study: Amazon Tax & Legal Structures

In this episode, we cover Amazon tax and legal structures for your FBA business.

- How to set up an Amazon business properly

- What type of legal formation is BEST for Amazon FBA sellers?

- Sales tax and income taxes?

- What is Nexus?

- How to keep accurate books?

- Missed an episode? See them all here.

We’re covering all of this today in our eleventh episode of the Million Dollar Case Study. Watch the video, keep reading and don’t forget to claim your EXCLUSIVE MDCS Jungle Scout discount!

Subscribe to the Million Dollar Case Study list here, so you never miss an episode!

Before you get started, if you’re not already using Jungle Scout, you’ll need to get a Jungle Scout subscription to follow along with us and complete your product research.

To help you out, we’ve put together a Jungle Scout discount code that gives you more than 30% off Jungle Scout – both the Web App and Chrome Extension! Plus, you get a pretty fantastic FREE t-shirt to go with it.

Welcome Back to the Million Dollar Case Study!

Today, we’re going to be talking about legal structures and taxes. Although this isn’t a super exciting topic, it is vital to understand the basics of this subject matter to ensure your success as an Amazon FBA seller. I don’t want you to be this guy come tax time:

Please note: I’m not an attorney and Jungle Scout isn’t licensed to give you official legal advice. Everything that follows is based on our experience as Amazon sellers and consulting with legal experts.

By the end of today’s blog post, you’ll understand more about legal structures, whether or not you need one. We’ll also be touching on two different tax topics: sales tax and personal income tax.

Let’s get started with the most common question I get about legal structures: “Do I need an LLC?”

Do I need an LLC?

An LLC (Limited Liability Company) is a type of legal structure/entity that is very easy and inexpensive to set up, and that’s what makes it popular for small businesses. Technically, you don’t need an LLC to have an Amazon business, you can register for an Amazon account as a sole proprietor, as long as you’re a U.S. citizen. If you live somewhere else besides the U.S. or you’re not a U.S. citizen, then you will need a legal entity in order to register for an Amazon Seller Central Account.

Here’s how I like to look at it:

- If you’re just testing this all out, you can open your Amazon FBA store as a sole proprietor then migrate up to an LLC down the road

- If you’re serious about making this a business, go ahead and do the LLC now

- If you’re a Non-U.S. citizen and you want to sell in the U.S. Amazon marketplace, you will need to set up an LLC

The benefits of an LLC:

- Forming an LLC gives your business a legal identity. In the eyes of the law, it’s a separate “person” that can own money and property, have a bank account, make agreements, sue people, and be sued.

- Because of this, your business’s creditors can’t go after any money or assets that aren’t owned by the LLC. Your home, bank account, and other personal assets are protected. By contrast, if you operate a sole proprietorship, you and the business aren’t legally separate, and everything you own is at risk.

- Some companies, like wholesalers or some freight forwarders, will require an LLC

Do I need to register my LLC in my local state?

If you have a local presence, like a brick and mortar business in your state – you would need an LLC formed in your state. In most states, if you have an “Internet” based business as we do with an Amazon Seller account then it doesn’t really matter what state it’s formed in. I recommend checking with your local state authorities for their current regulations.

💡PRO TIP: I personally have a bias towards Wyoming LLC’s because they are very easy and inexpensive to set up. And my agent of choice is the Wyoming Registered Agent Services LLC.

Does my LLC name have to be the same as my Amazon storefront name or my Amazon brand name?

The answer is no! So, I could just call it “The Rolando Galeana LLC” and then my Amazon storefront name could be “Jungle Creations” and my product brand name could be “Jungle Slider”, and that’s perfectly fine.

Go ahead and get an EIN number

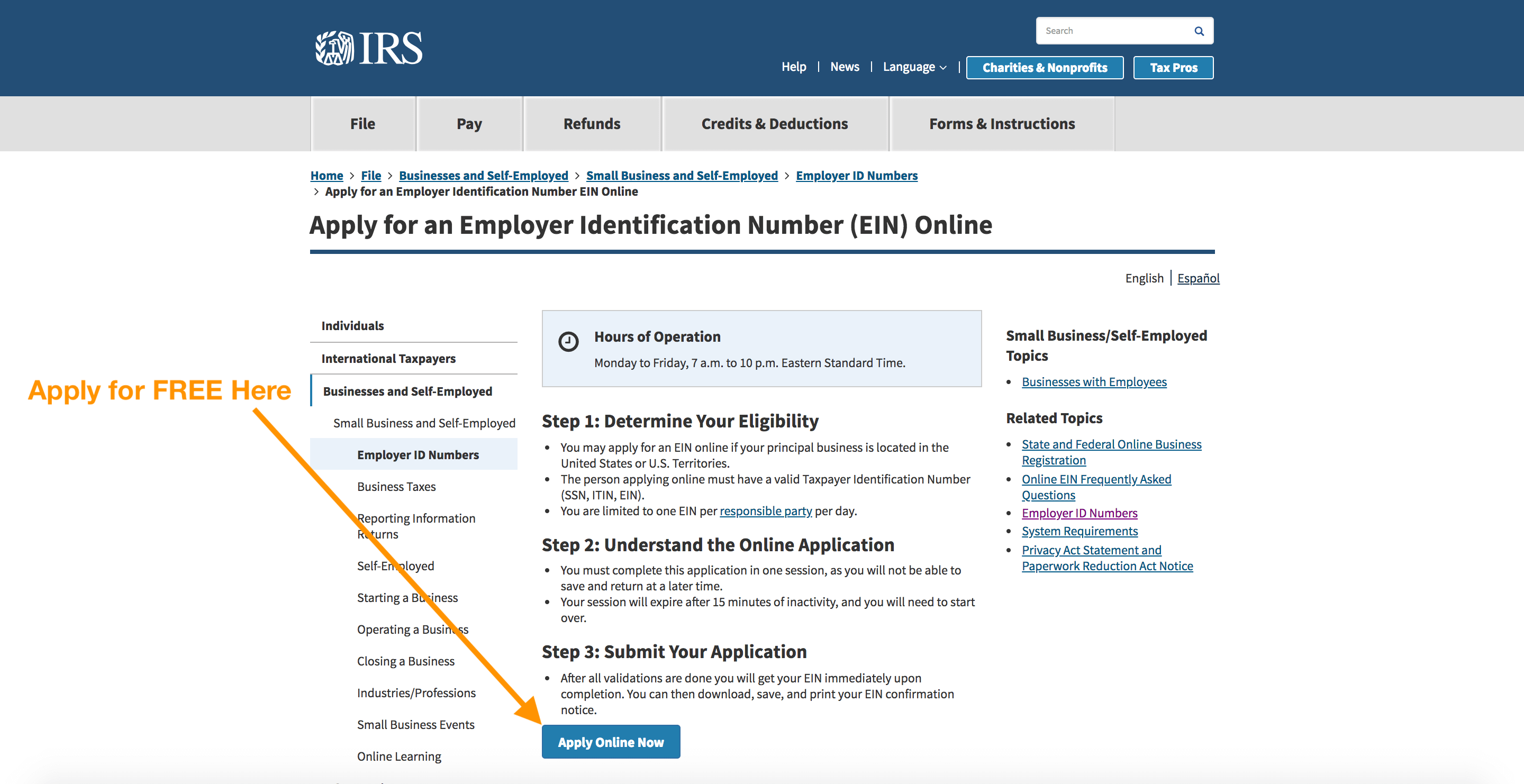

An EIN (Employer Identification Number) is a unique 9 digit identification number that is assigned to a business entity so that it can easily be identified by the IRS. Think of it is as your business’s own social security number. Once you’ve set up your LLC you can then get an EIN for free by applying online at the IRS’s website.

You’ll need this EIN for opening up your Amazon Seller Central Account, opening a bank account under the legal entity’s name and ultimately for paying your taxes.

Open a bank account under the legal entity’s name

For starters, opening a bank account under your legal entity’s name just makes bookkeeping much easier. Secondly, in order to maintain the benefits that the LLC gives you, you cannot co-mingle personal and business activity.

So, the best thing to do is to go ahead and open a bank account under your business’s name, deposit some of your personal money into that bank account in order to fund this business, and going forward all business related transactions should flow through this bank account.

So when you’re paying suppliers, you should pay them out of this bank account.

When you’re receiving deposits from Amazon, they should go into this bank account. And any other expenses associated with your business should come out of this account.

This keeps your transaction history nice and neat and totally separate from your personal expenditures. This also helps down the road if you ever want to sell your business or take on a partner or investments, or anything else that has to do with your business.

Making sure you register all business accounts under that LLC

Of course, you’ll want to register your Amazon Seller Central Account and your bank account in your business name but also other things like if you’re buying domain names or if you open up an eCommerce store or anything else. Just make sure to register all accounts under your LLC’s name. And this again just helps with the liability protection knowing that they are part of your business and not your personal identity.

Hey, why aren’t you talking about S Corporations, C Corporations, or Partnerships?

There are other types of legal entities that you can use to create companies. S Corporations (aka S Corp) are another popular option for small businesses. However, they are more difficult to set up and maintain, and they only have tax benefits for a certain population of people. The easiest option is to create an LLC and then, down the road, talk to a tax professional and decide whether or not you’d want to form an S Corp.

Summary of legal formations

If you’re just testing out the waters and you’re a U.S. citizen then you can opt to just go with a sole proprietorship. If you’re ready to take this business seriously, go ahead and create a legal entity, and an LLC is going to be right for 98% of the people.

Here are some details of having an LLC:

- The Members who own the LLC cannot be held personally liable for the company’s debts or liabilities

- Legally, the LLC has similarities to Corporations, except in regards to how taxes flow through to the owners of the company

- You can signup for an LLC as a resident OR a foreigner

- If you are the only person running the business, you can be a Single Member LLC

- If you have multiple members in your LLC, you can elect to file with the IRS as an S Corporation

- In most states (check with your local state authority) for internet-based businesses where you don’t have a local presence, you can set them up anywhere in the US. Delaware and Wyoming are the two most popular states to set them up, or, your home state.

- If you decide to set up a Wyoming LLC use the Wyoming Registered Agent Services LLC site

- Register for a free EIN on the IRS website

- Register all your accounts, like Amazon, with your LLC name

- Open a separate bank account for your LLC and keep bookkeeping separate

Taxes

As an Amazon FBA seller, there’s essentially two types of taxes that you need to be familiar with: sales tax and income tax. Let’s start off by talking about sales tax.

Sales Tax

This is a direct tax on consumption that many states and local governments impose when you purchase goods and services. The taxes you pay are typically figured as a percentage of the sale price. Sales tax is assessed at the point of sale, collected by the retailer (in our case Amazon), and passed on to the government.

Good News

Amazon can collect sales tax for you!

- Register for a sales tax license

- Enable sales tax collection in Amazon Seller Central

-

Cost is 2.9% of the tax collected

- If you collect $10 in sales tax, the fee will be $0.29

- File and pay when the due date rolls around

- Software like TaxJar can help automate this process

When should I collect sales tax?

The “Golden Rule” of collection:

- Comply in your home state

-

Would a sales tax bill break your business?

- Register and start collecting

-

Would you only owe a few bucks in a state?

- You might want to wait

I keep hearing about sales tax nexus, what the heck is that?

Nexus is the determining factor whether a presence or connection to a state is significant enough for you to be required to collect and remit sales tax.

Essentially, it means what states do you, as a seller, need to collect and remit sales tax in.

Sales tax can be collected by Amazon, but then it’s up to you to actually remit it to the respective states. And it’s also up to you to tell Amazon which states they should be charging sales tax in for your particular products.

What I see most Amazon sellers do is they will collect and remit sales tax in their home state. If you are a risk-averse type person or your business is growing and getting quite a bit larger, you may want to do a Nexus study or use a tool like TaxJar to help you understand what other states you may owe sales tax in.

Income tax

Income tax is what you owe the federal or state government from the money you made. Take your profit, subtract your expenses and that is your income.

Depending on your tax bracket, you’ll owe a certain portion of that to the government. If you’re currently a W-2 employee then this is similar but your company automatically withholds this money for you.

- You owe taxes on the profit you make!

- Income – expenses = profit

- If you don’t profit, you don’t owe any money. Whatever you profit, you owe a certain percentage of that to Uncle Sam.

- Write-off anything business related! If you start an LLC, write-off that expense! If you hire someone on Jungle Market write that off! If you’re using the Jungle Scout suite of tools, guess what? You can write that off too!

- In addition, an accountant at the end of the year can help you find other write-offs, like your home office, cell phone, internet, possibly your vehicle, etc.

You need to document all the expenses that you incur as a business. Whatever expenses you have, this is money that you don’t have to pay taxes on. So it’s important that you don’t forget about anything you bought to support your business!

Bookkeeping

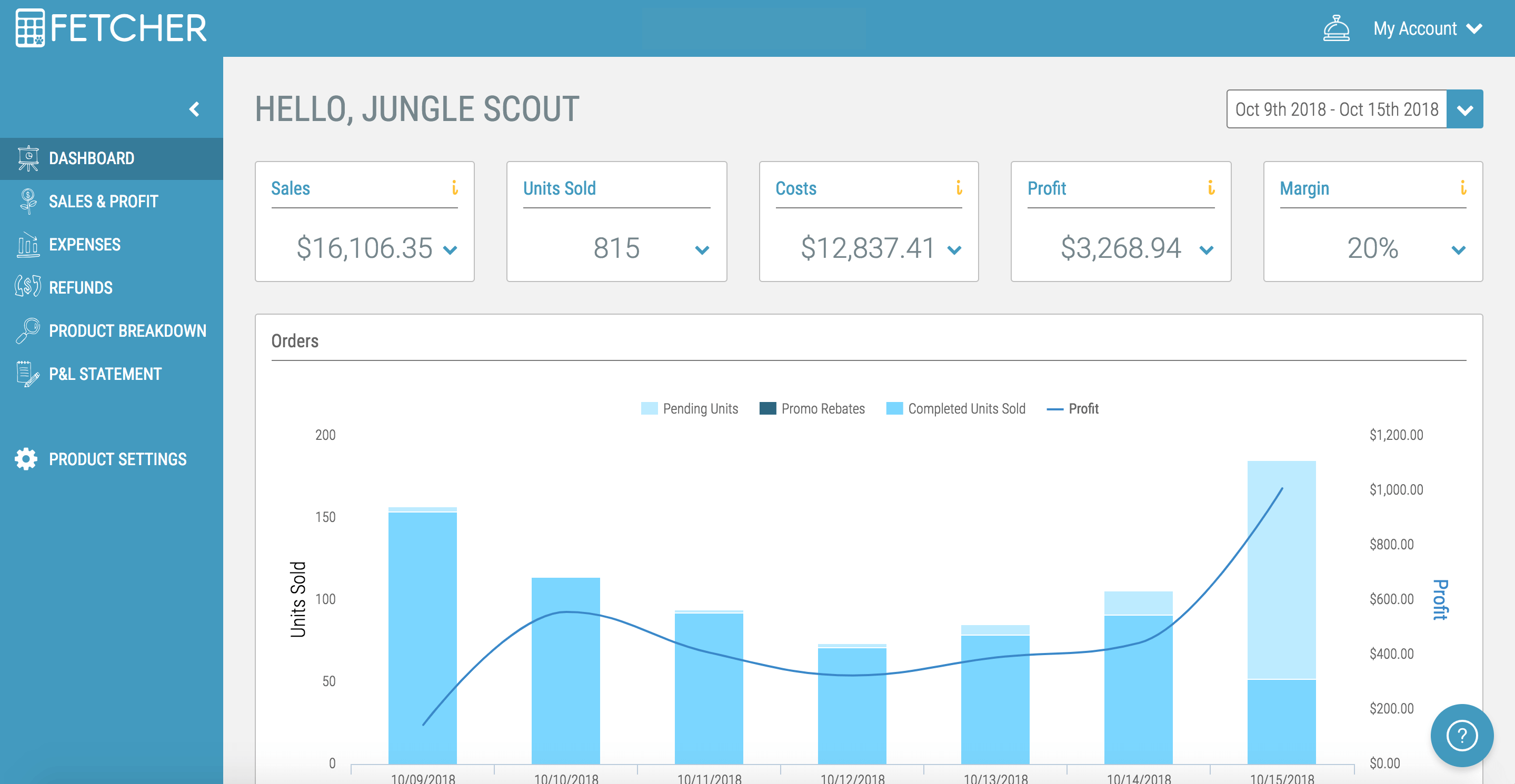

If you’re just getting started and only have one product on Amazon, you may be able to keep track of all your income and expenses within an Excel sheet. If however, you have a little bit more of a sophisticated business, or you don’t love Excel, you can use a tool like Fetcher to keep track of all of your income and expenses.

Full Disclosure: Fetcher is one of the tools in the Jungle Scout family, we built this a few years ago after personally experiencing all the headaches associated with proper bookkeeping and profit analytics on Amazon in general.

Fetcher

- The #1 Accounting Software for Amazon Sellers

- Product breakdown on a per ASIN basis

- Pay Per Click cost and sales analysis

- Product promotion tracking and real costs

- Amazon fees – storage, FBA and everything else

- Refund tracking with comparisons and costs

- Costs of Goods Sold tracking and calculations

- Inventory dashboard

- Professional Profit and Loss Statement

- Daily sales and profit email

Conclusion

This is a lot of information, but you don’t have to be an expert on any of the topics discussed today. All you need is to arm yourself with some basic information and take action!

If you’re just testing out the waters and you’re a U.S. citizen then you can opt to just go with a sole proprietorship. However, whichever legal formation you decide to roll with, always keep your personal expenses separate from your business expenses for accurate bookkeeping.

Lastly, when it comes to sales taxes, start off by collecting and remitting sales tax in your home state and gradually tackle the Nexus beast with tools like TaxJar.

Well, that’s all for now! Stay tuned next week as Greg and I dive deep into one of my favorite subjects: Launch Strategies!

Now it’s YOUR TURN!

Start doing some research of your own! Every week, we’ll be giving you your Action Items and Weekly Workbook and exclusive hacks to make the most of your MDCS journey.

Get your FREE MDCS Workbook HERE!

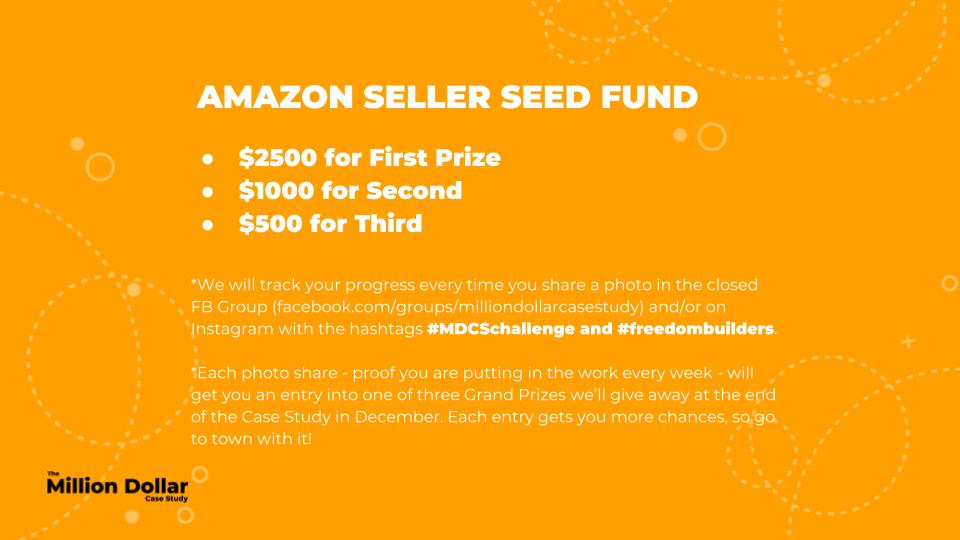

After you’ve completed the Action Items found in the Workbook, post your progress in the Million Dollar Case Study Facebook Group! You don’t have to reveal all of your best ideas – just let us know you’re working on them! You can also post them to Instagram with the hashtags #mdcschallenge or #freedombuilders.

Here’s what you could be eligible to win at the end of the MDCS! We’ll be drawing for names and the more photos you post and share as the weeks go on, the more chances you get.

We donate 100% of our product proceeds to Pencils of Promise.

They build schools in developing countries to help children get access to the education they need for a strong foundation.

Our favorite project is the Million Dollar Case Study. It’s a team-wide effort and we value every opportunity it gives us to connect with sellers like you.