Blog: Webinar Recap: How to Sell Your Amazon Business For Profit

Webinar Recap: How to Sell Your Amazon Business For Profit

Welcome to our latest exclusive webinar recap. This is an exciting webinar on a new topic here on the Jungle Scout blog – how to sell you Amazon business with Justin, Joe and Mike from Empire Flippers.

Many Amazon sellers might not even realize that they're really building an asset with their business, which is why I wanted to hold this webinar to give sellers a little something to think about. So buckle up if you want to learn everything about the wild, wild west of selling a business.

What will I learn?

- How are FBA businesses valued

- How to maximize the value of an FBA business

- The process for selling an FBA business

Pretty much everything you need to know whether you are looking to sell soon, in the future or just maximizing the value of your business and keeping your options wide open.

What's your exit strategy?

Even if you don't plan on selling your beloved FBA business, it's still useful to know the value of your business in case your situation changes. Plus, how neat will it be to tell your friends how much your thriving business is worth?

As brokers, Empire Flippers help people buy, sell and invest in online business, so they really are experts in this field. Did you know there are people out there looking to buy FBA businesses like yours? The Empire Flippers team have sold 11 in 2016 alone, with valuations of between $50 – $1.5m.

Valuations on FBA businesses

Here, the guys give us the scoop on their formula which is as follows:

Valuation = (Monthly Net Profit X Multiple) + Inventory At Cost

Let's break this down.

Monthly Net Profit

- Ideal to use monthly net profit is a 12 months average

- Sometimes a 3 or 6 month average can be used when the business is in a high-growth phase, but only if it's indicative of a realistic view of the future

- An average needs to be extrapolated from what a buyer would expect to make on a monthly basis going forward

- Expenses are negotiable – if you take a salary that won't go against your monthly net profit. Only things that are absolutely required to maintain your business will be taken out of your monthly net profit, for example, business trips to China. Justin makes the point that if you take vacation to Tahiti, this doesn't necessarily need to be deducted from profit.

Multiple

The multiple range can be anything from 20x – 40x and up.

- Larger multiples will typically be the businesses that have been around longer, are larger in size, with more longevity and proof, and less risk for the buyer. Full 12 month averages are usually required.

- Smaller multiples tend to be smaller businesses with less longevity and a shorter 3-6 month average monthly net profit.

If your business is less than a year old, you may still be able to sell your business, but you are much less likely to get a larger multiple.

If you business is new but only started showing good earnings in the past few months, then it may not meet criteria. In this case you should keep working on your business with a view to maximizing the value if your end goal is to sell.

Inventory At Cost

Here we're talking about landed cost of your inventory, including packaging, shipping, everything all in.

Bear in mind that if you have stocked up with lots of inventory, this might be scary to a potential buyer of your business. They won't know if that inventory is dead or if the price is reasonable.

Justin's rule of thumb for selling inventory to a buyer is to sell for 5-20% of the sales price.

On the other hand, if you're running out of inventory when trying to sell your business, this can cause issues with negotiations too. The new buyer don't want to immediately run out of inventory when they take on your business.

Try and hit that sweet-spot of having just enough inventory. Not too little and not too much!

Real Life Examples

What I love about this Webinar is that the guys even shared some of the businesses that they have successfully sold over the past 60 days.

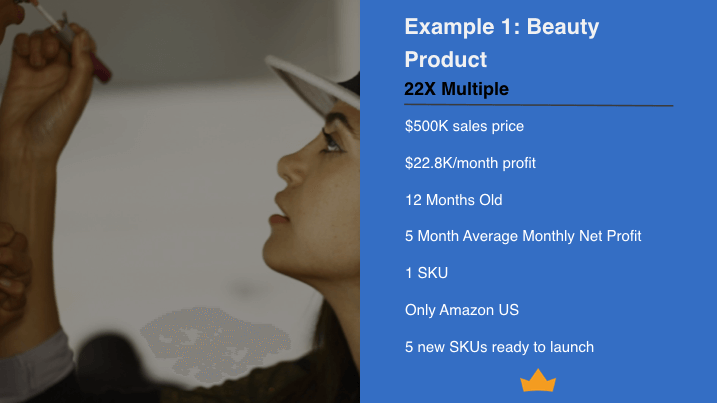

Example #1

First up Mike ran us through this example of a product in the beauty niche. That's right, it sold for $500k for just one SKU, with a short 5 month average.

The thing that really helped to sell this business though is that there were 5 new SKU's ready to launch.

The multiple was quite low at 22X multiple, which is attributed to the short 5 month average. But as Justin points out, this business owner did really well to build up a $23k/month profit business inside 12 months.

Example #2

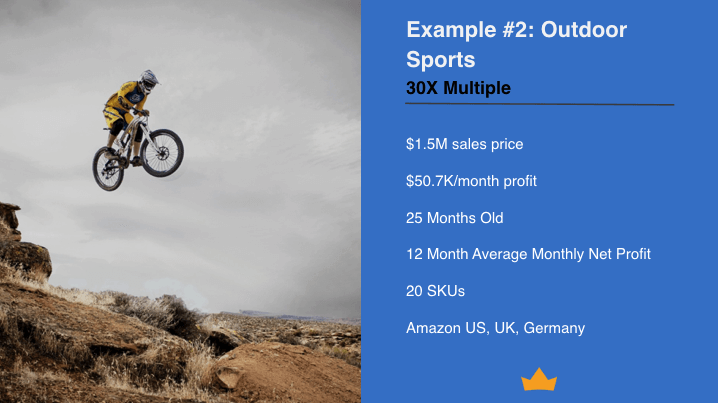

This example has a higher 30x multiple and they used a 12 month average. The things it really had going for it are that there are several SKU's in a similar niche, the business was 25 months old, and they sold in multiple marketplaces.

So here you can see that inside 2 years, this AMZ seller crushed it and sold his business for $1.5m. Not bad!

How to Maximize The Value of An FBA Business

So you want your business to be worth more right? Whether you are looking to sell up or not, this is important for any business owner.

Here the guys take us through 6 key elements of maximizing the value of your business:

Separate Company

In an ideal world you will sell your business under ONE LLC/Corp. A sale of your business is an asset sale – your buyer is buying your product, your rank on Amazon. It is also preferable to have a seperate business bank account where all of your Amazon sales will go out of.

No personal transactions.Mike had a great example here, that if I wanted to sell the Jungle Scout collaborative launch product, Jungle Stix, it would be the best case scenario for it to be in a seperate LLC to any other business, and also have it's own bank account.

Tip: If you are thinking of selling your Amazon FBA business or specific products in the future, set up a seperate LLC/Corp and get a separate bank account now to make sure you are ready.

Detailed Financials

Two things you will need are an income statement and a cashflow statement. Ideally you will be using some accounting software such as Quickbooks or Xero. Here's how your cost of goods is evaluated: COGS = # units sold X landed cost.

But you are always going to want to show potential buyers a complete picture of your cashflow. They will want to know months where you were down due to inventory, what landing costs are, how many items you sold and what the average monthly profits are.

Tip: Fetcher would be the perfect tool if you're thinking of selling your Amazon business. It would be able to give a potential buyer additional information such as costs promotions, Amazon PPC, software and more.

Work Required

You want to cut expenses if possible, as it improves your net profit and thus, your evaluation. BUT, and there is always a but, you don't want to add any work. For example, you don't want to move the packing and shipping into your garage, as most buyers would not be interested in running the business on that model.

Other things that are good to outsource are things like customer service to VA's. It's not terribly expensive and reaps many benefits when it comes to selling.

Minimized Buyer Risks

Buyers will be harsh. They don't care if you sold your car, spent all your savings and worked 60 hour weeks to start your business. They will pick out any points of failure, so it's important to minimize those. Good things to have are multiple SKU's, multiple suppliers, multiple traffic and sales channels and targeting multiple keywords.Bad points could be single SKU's, one supplier, only selling on US marketplace.

Essentially, if all of your eggs are in one basket, your buyer will see that as a risk. How can you prove to them that if one product drops, or you stop getting traffic for specific keywords, how would the business survive?

No Touching Inventory

As we have already discussed, buyers don't want to be heavily involved in handling inventory and shipping. Limit involvement in anything involved, including quality control. This will increase your buyer pool.Justin and Mike recommend using fbainspection.

People & Processes In Place

This one might seem like a pain but make sure you document your processes! Most businesses adopt a “just get it done” mentality. However, this makes it tough to train a new employee, or show to a potential buyer how your business functions on a daily, weekly and monthly basis. If you do have a team, or are hiring VA's, make sure they are trained. This adds value to your business.

If you ever ran into problems in the past with trademark issues – document this too. It's really attractive to a buyer that you have already got a process to action against this risk.

Bonus Tip: If you have an additional traffic and sales channel, such as your own ecommerce website or your own email lists, that is generating say 30% of your sales, this is a fantastic asset to any potential buyer. However, if you're thinking about where to focus your efforts, Justin recommends doubling down and focusing on FBA, unless you're in it for the long haul and plan on building your own brand.

The Process for Selling An FBA Business

At Empire Flippers they have a 6 step process for selling FBA businesses through them. This includes:

- Initial Valuation

- Sell Now Or Later?

- Documentation to Prepare

- Vetting Process

- Negotiations

- Business Transfer & Payout

If you want to get started, or if you're curious, find out what your business worth today. Head to the free valuation tool on Empire Flippers to get a rough estimate on your business.

Here's the full recording of the webinar if you missed out and want to give it a watch:

Final Words

I hope you found that interesting and thought provoking – I certainly did. There's a whole host of considerations to make, depending on if you are looking to sell your business soon or just keeping that option available to yourself.

Personally, I think it's worth bearing all of these insightful tips in mind and ensuring that you are prepared for any eventuality.

Let us know in the comments if you're planning on selling your business, or if you already have, how you went about it?