Blog: The Million Dollar Case Study Session #8: How To Import from China

The Million Dollar Case Study Session #8: How To Import from China

The Million Dollar Case Study continues this week with our session on importing. And who better to join us than Philip von Mecklenburg-Blumenthal, Senior Director Marketplace at Freightos. And when you want to learn about freight, importing from China, and shipping, there isn’t a more appropriate person to learn from. After 15 years in the freight industry, incuding a PhD thesis on ocean freights, you can trust that Philip knows his stuff!

The best part is that he broke everything down into easily understandable content, even for those who are just addressing their first experience importing their product.

Even if you don’t make it through the whole video or recap below, but you are interested in getting a shipment imported, there is a nice discount at the end of this post:

Here is the video recap of the webinar:

Here are Philip's slides:

So the key takeaway from the session is Philip’s reassurance – shipping is actually not that complicated… until you start taking in too much information and complicating it.

A lot of it is common sense, and there are resources and guides to help you through the process.

A quick note on Freightos

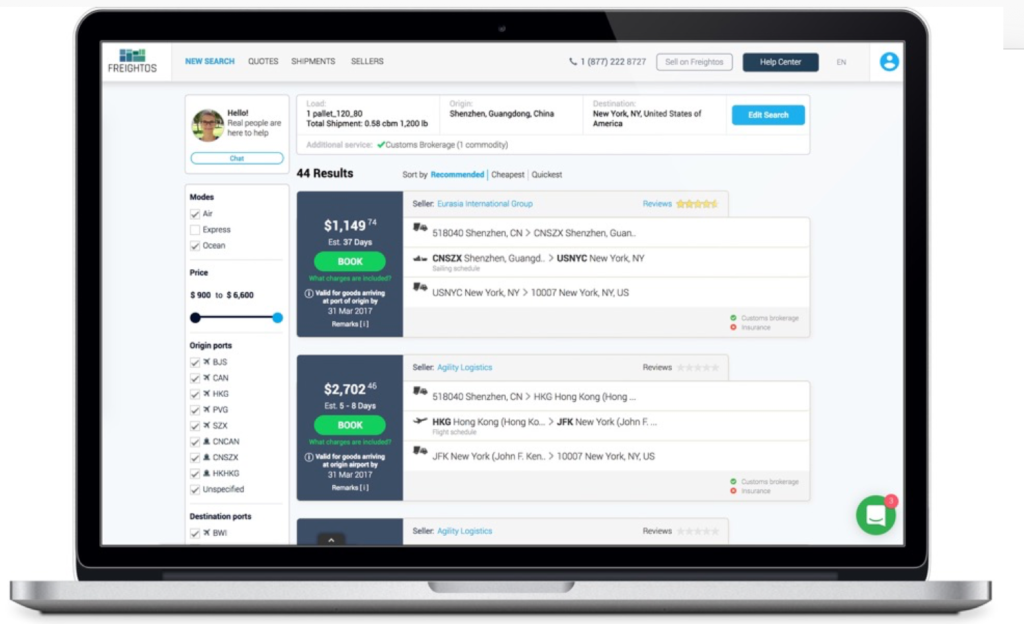

Freightos is a marketplace and comparison site for freight forwarders. Like Kayak for freight forwarders. Simply enter some key information about your shipment: what your shipment is, the volume, weight, from and to destinations, and get your hands on a range of different quotes. Once you enter that info, you are connected with a variety of rate quotes from freight forwarders, making this part of the task much simpler and quicker.

Freight forwarders are like travel agents for your product. They arrange the transportation, the paperwork, the forms and whatever else you need to get your product from Point A to Point B.

Pre-Shipment Checks

Before you start down the road of looking into importing your product, you have to ask yourself some basic questions. Namely, can this be shipped?!

There are some products that have special restrictions on importing, or restrictions from Customs and Border Protection, or other international agencies.

A simple Google search like “can I import [your product]” is a good place to start. Freightos also has a list page to help you figure out if your product may be hazardous, which you can see here:

Here's sample list, (not exhaustive), to give you an idea of the random products that can be considered hazardous:

- Camping gear/ equipment (signal flares, heat producing packets, cooking stoves)

- Cosmetics and perfumes

- Frozen food

- Biological materials

- Certain battery powered equipment

- Small gas cylinders and aerosols

- Toolbox items (propane torches, touchup paint, adhesives, urethanes, epoxies)

- Equipment containing radioactive sources

- Breathing apparatus & diving equipment

- Dry ice (for air shipments)

- Household goods (paints, bleaches, spray cans)

- Laboratory/testing equipment

- Refrigeration equipment & mercury switches

- Fire extinguishers

- Magnetized material (by air)

Shipping Jargon Explained

Before going too far into any details, let’s get an understanding of the common shipping terms used. In shipping parlance, these are known as “Incoterms”, which are the trade terms published by the International Chamber of Commerce and used universally in trade contracts.

This is where confusion can cloud over the whole process. Thankfully, Philip pulled out just the few that are most important to us as Amazon sellers.

These are international standards for who is paying for the freight, and who is taking on the risk of the shipment.

EXW, or Ex Works

This means that the factory is only responsible for getting the goods out of the factory. The supplier is not responsible for loading the goods on the transport vehicle, getting the goods to the port, or anything beyond making the product and getting it out of the factory. You as the seller take on all cost and risk from the moment it is out of the factory.

EXW will generally mean that you pay more in additional fees.

FOB or Free On Board

The factory will assume responsibility for the goods all the way through getting the products to the port of shipment. You as the seller assume costs and responsibilities from this point. FOB still requires that you as the seller clear the goods for export.

DDU or Delivered Duty Unpaid

The factory has complete all responsibilities at the country of import (for us, this would be the United States). The factory would pay for all costs and liabilities associated with shipping to the destination country, but you as the seller are responsible for duties, taxes, and other fees related to final clearance.

DDP or Delivered Duty Paid

This means that the factory is responsible for all costs and liabilities of getting the goods to the country of import, with all duties, taxes, and other fees paid for and cleared for import.

Philip’s important recommendation here is to pay close attention to the terms of shipping that are used when negotiating prices with your factory. For example, if your factory offers to cut the sales price but changes incoterms, you may not actually have negotiated a better price in the end. So make sure that you consider all of these terms to calculate your landed cost before you agree to pricing with your supplier.

Also, it is recommended to ask for FOB. Why? If you get FOB, you can get control of the shipment and don’t have to rely on your supplier as much in the importing process.

The Shipping Process

Right, jargon out of the way, let's walk through the steps you need to take to get your inventory shipped. Philip has broken this down really well so it's super easy to follow…

A Note on Packaging

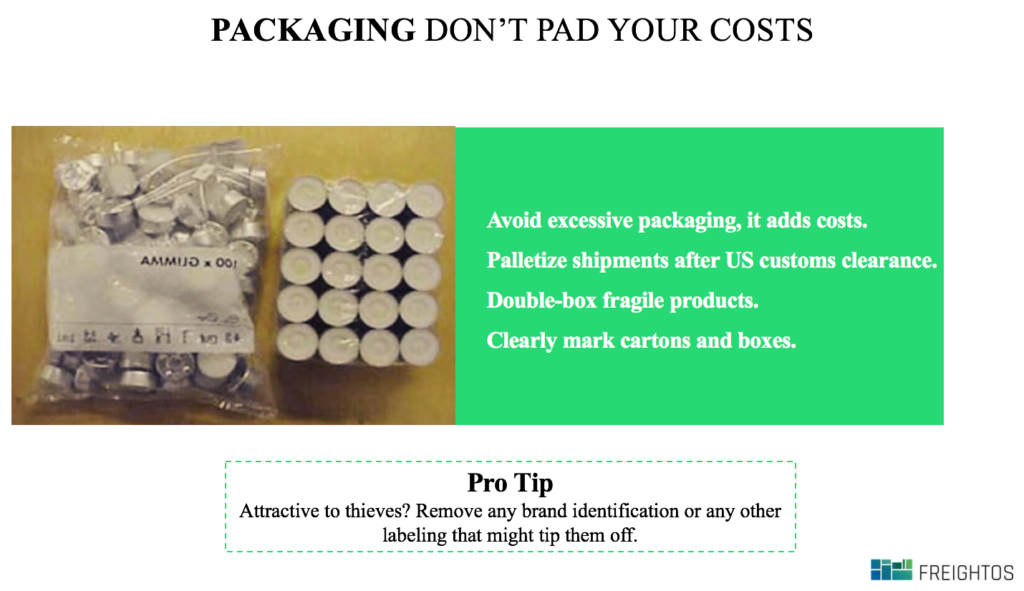

Unnecessarily bulky packaging can cost you a lot if it takes up a lot of extra weight and space. A key recurring theme is to make your shipment as efficient as possible, otherwise you end up with increased time or costs.

One other way to save on shipping is to palletize the shipment after your goods have cleared US customs. This allows you to save space, and therefore time and money.

And lastly, work with your supplier and freight forwarder to confirm that you have properly labeled and marked your shipments.

Which mode of transport to select?

So now we come to the question of which method we use to transport our goods.

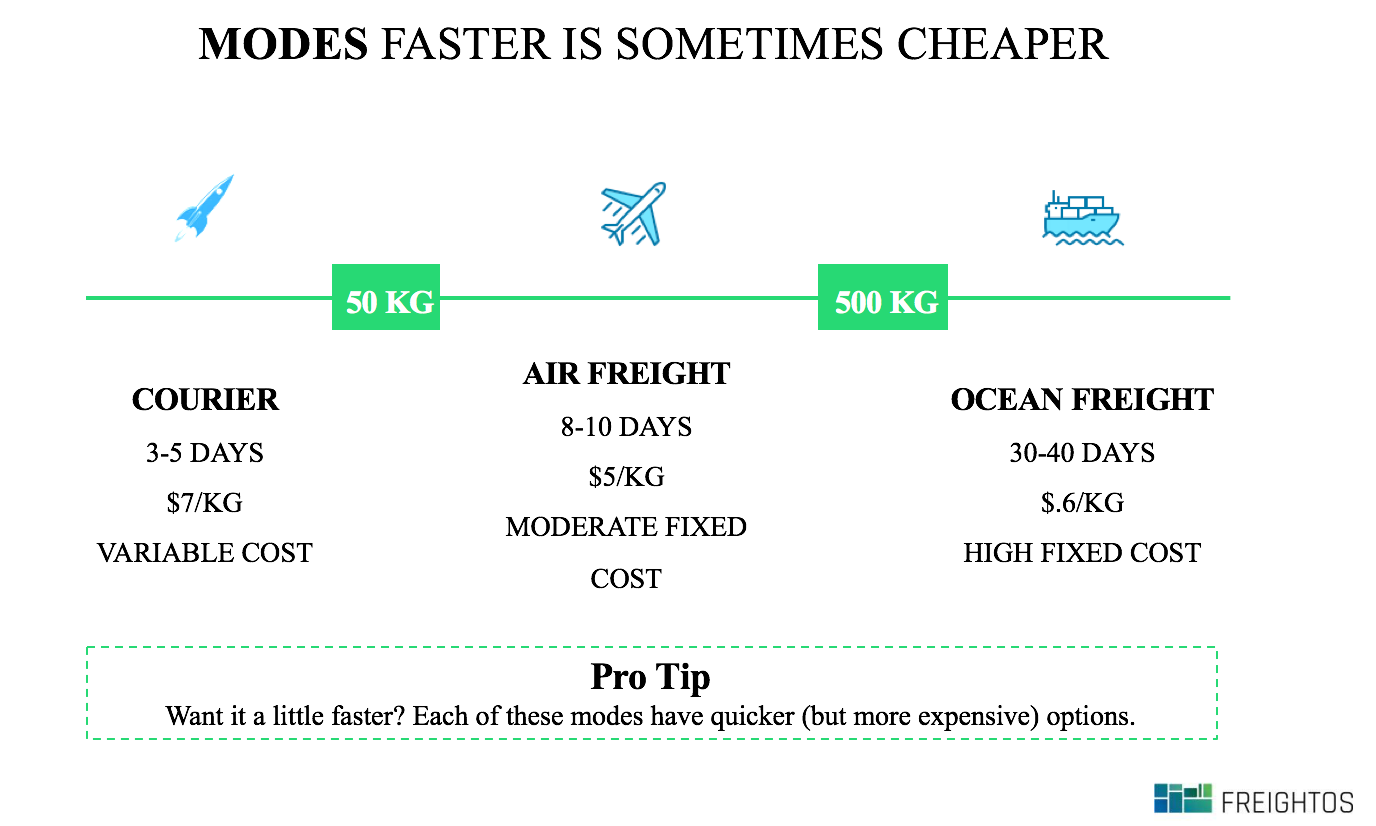

Depending on the size and desired timeline, air or ocean may be more cost-effective. Here’s a handy graphic Philip shared, that includes some rough cost estimates per kilogram:

Ocean or Air?…

Basically, if it is under 50 kilo or under 100 pounds, using courier is the cheapest after you account for various fees. This should take 3-5 days from door to door, assuming China to US.

So for getting samples from a factory, for example, you would want to use Air Express.

If your goods are between 100 and 500 kg, your best option is air freight. On average, this will cost you $5 per kg, from China to US. However, this will also require some fixed costs for transportation,

Ocean Freight costs roughly $0.60 cents per kilogram, though this estimate depends on whether you are ultimately getting your product to the east or west coast of the US. You will have some additional fixed costs for transportation and delivery costs, as well as customs fees. The nice thing though is that even if you double the weight of your shipment, your costs wont’ go up very much. This is especially true if you are paying for a whole container—your prices won’t vary much based on the weight.

The Quote

To get the process of importing your goods started, you will want to generate some quotes. You just need some basic information to get a quote:

- Dimensions

- Weight

- Origin zip code or port

- Destination zip code or port

- Shipment value – this refers to the value of the goods that you as the seller paid for them. Not how much you are selling the goods for.

Philip highly recommends getting cargo insurance for your shipment. It will cost about $0.60 cents for every $100, but will cover you if anything in your shipment is damaged, stolen, or lost. So seriously consider comprehensive cargo insurance, which it will keep you covered. A small additional investment, but worth the outlay in spend.

Paperwork

Philip says to expect 10 to 20 documents to fill out, if you are shipping by ocean freight. If you are working with a freight forwarder, they can explain everything here in detail.

Here are the main forms that you will need to complete:

- Commercial Invoice – This is the invoice you get from the factory, lists the value of the goods, the invoice you have to pay, and who’s selling it (the factory to you). This commercial invoice is needed at least 48 hours prior to the departure of the goods from port, so you want to have this prepared to avoid any hold ups.

- Packing list – The packing list is simply a list of what is in the container and what is items being shipped. You want to review this carefully (it will come from your factory). If there is any mistake, you need to go back to factory to get it fixed asap.

- Material Safety Data Sheet (MSDS) – This form is only needed when you have hazardous goods, anything with explosives, batteries….the details matter here!

- Power of Attorney – This is a form you receive from the freight forwarder, in which you complete and give to the freight forwarder. The Power of Attorney is needed to eventually clear customs.

The key takeaway from these forms is that you want to thoroughly review the documents (I know, it is a lot to take in, and quite tedious!), but even small errors like spelling can add delays or costs, so make sure to have everything lined up!

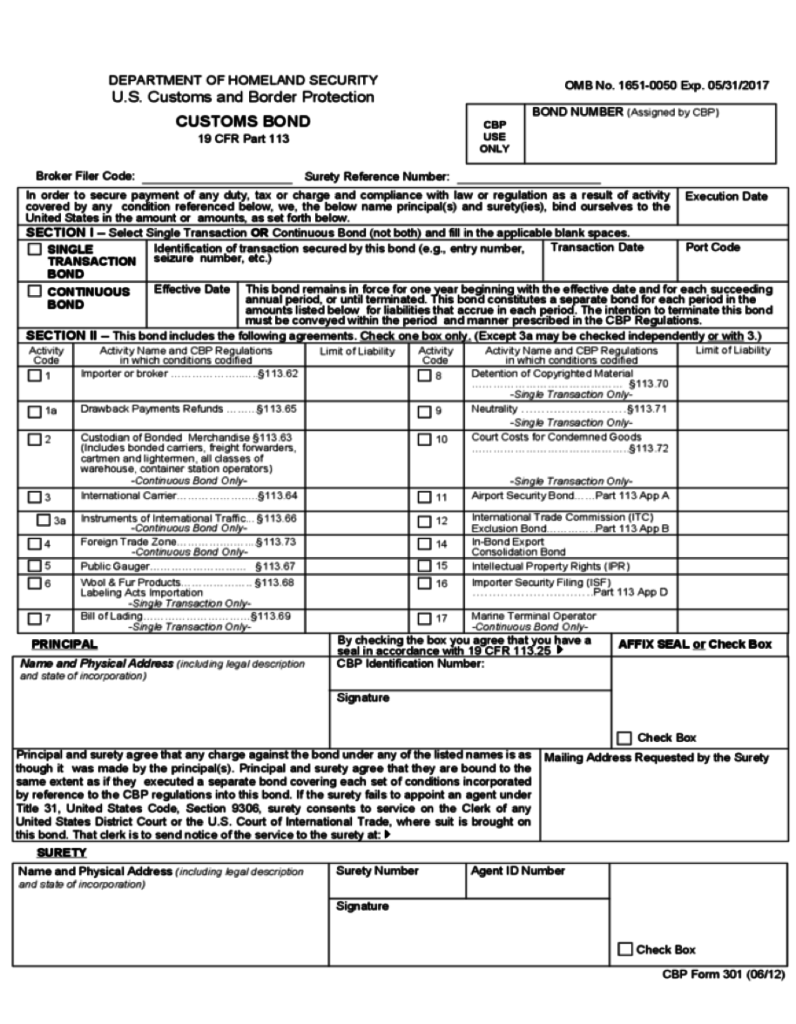

Customs Bond

A Customs Bond is required to have your goods clear US Customs for any inventory that is greater than $2000 in value.

There are two common types of bonds used most frequently by Amazon sellers: a Single Entry Bond and a Continuous bond.

The Continuous Entry Bond lasts for 12 months, and costs $500. You can use it as many times as you want to import your goods. If you are importing more than 4 times per year, you are better off paying the $50 0 for the continuous entry bond.

A Single Entry Bond is $125 to use for a single shipment. Fill it out once, use it, and get your single shipment cleared.

Your freight forwarder can help you figure out which bond would be best for you, and help you complete it. Here’s a copy of what it looks like:

Delivery

When you are coordinating a variety parties and working in international importing, Philip recommends always adding in an extra buffer to finally get your delivery. There is always a chance that something can go wrong or a hold up occurs somewhere.

If you are shipping to multiple locations, consider consolidating the shipments in China, send to one port, and then have your forwarder split and deliver separately once it has cleared US Customs.

And if you are ultimately delivering your products to Amazon’s warehouses, make sure to mention that to your freight forwarder, as there are specifications for an Amazon shipment that they should know about (ie how pallets are built, setting up an appointment with Amazon’s warehouses, etc).

But Wait, There’s More…

One more thing before you go! A nice discount from Freightos!

If you need a freight forwarder, and find one on Freightos, make sure to mention Jungle Scout in the comment when checking out— there’s a $100 credit off your first $1000 shipment.

Note that Jungle Scout is not affiliated with Freightos and receives no compensation for this, it’s just something they offered to our audience.

This webinar just scratches the surface of the details of shipping your product from China.

- There are some great resources on their site: Freightos Resoures

- As well as a rate estimator: Freight Rate Estimator

And if you have any additional questions, you can reach out to Philip directly: philip@freightos.com

Next week the Million Dollar Case Study continues with some insights on leveraging Amazon’s platforms to launch your product. We have Joel Lentz from the Amazon Business Development team join us!