Blog: The Good, the Bad, and the Ugly: Sourcing Outside of China.

The Good, the Bad, and the Ugly: Sourcing Outside of China.

By Gary Huang, Founder of 80/20 Sourcing

With the recent trade war between the US and China heating up, many business owners sourcing from China are considering other options. Sellers, because of the increase in import tariffs (up to 25% in some cases), are thinking about moving their supply chains away from China to lower their costs.

However, China makes almost half of the products sold and used worldwide for a reason. Not only does its factories have years of experience, they also provide businesses with a complete supply chain of raw materials, a capable labor force, and smooth logistics.

So, with all the positives, why source away from China?

In addition to the recent tariff hikes, the cost to do business in China rises each year. Increasing labor costs, stricter environmental laws, rising material prices, and other factors make it more and more expensive to source from China.

Potential language barriers.

Besides that, competing countries like India promise buyers an ease of communication that China can’t provide.

Since English is the second language of the majority of Chinese manufacturers, it can lead to misunderstandings between sellers and Chinese suppliers. But with English as their primary language, mix-ups are less likely with Indian suppliers.

Products not found in China.

There’s also a good chance that other countries may be able to manufacture products not found in China. This could make it more difficult for your competitors to copy you.

These manufacturing alternatives usually allow for product customization too. And having a unique product is key to protecting your business from competitors!

Smaller orders.

Another plus for sourcing outside of China is order size. Some business owners have found that other countries tend to allow sellers to purchase in small quantities.

Not only does this mean sellers can start with a minimum order quantity (MOQ) much lower than 500 pieces, it also means a lower initial capital investment. This further increases a seller’s competitive advantage, especially when testing new products.

So is this the right time to start sourcing outside of China?

There is no easy answer to this question. So, to gain a broader perspective, I surveyed dozens of small business owners and supply chain experts. They were happy to share their experiences regarding sourcing in Vietnam, India, Mexico, and other countries.

Here’s a rundown of their insights:

- When sourcing in countries like Vietnam and India, expect lower prices, but NOT necessarily huge savings.

- Finding reliable suppliers outside of China can be difficult. However, with Jungle Scout’s Supplier Database, the task is much easier than it was previously.

-

Sourcing away from China requires more work as there are trade-offs. There may be:

- longer lead times,

- products potentially lower in quality,

- dishonest suppliers,

- possible theft.

Overall, sellers spend more effort scrutinizing the above factors than they do when working with Chinese suppliers.

*Check out my cheat sheet summarizing how to source away from China.

Where else can sellers source products?

Broadly speaking, most businesses sourcing away from China consider using lower-cost countries. India, Vietnam, Thailand and Mexico, for example, often offer a lower product cost because labor is cheaper.

These countries are also less prone to increased tariffs, and have fewer environmental regulations (which increase factory costs). Government and tax subsidies, among other elements, can be more lucrative as well.

So, the idea is that these cost savings will get passed on to the suppliers’ customers.

Greg Wurgler, President of the Asia Business Unit at Electrical Components International, says that by moving manufacturing from China to Mexico, the company is able to be “in region for region”.

This means faster lead times, more working capital, and increased cash flow. And because shipping times are quicker when ordering from Mexico, sellers can order less inventory at one time.

Moreover, a small number of people are looking to more developed countries when sourcing products, such as the US, EU, and Japan.

From potentially higher-quality products to shorter lead times, products manufactured in developed countries usually offer a greater perceived value of the items. For example, when buyers see ‘Made in the USA’, many assume they are purchasing a better product.

What type of products are best-suited for sourcing from these countries?

Supply Chain Expert Dan Krassenstein, who sources products from China, Vietnam, and Mexico, recommends focusing on price-sensitive and less time-sensitive items when sourcing from India and Vietnam.

By shifting parts of his company’s supply chain to India and Vietnam, he said he’s saved 10-30% in costs.

Vietnam’s top 10 exports in 2017 (US dollars):

- Electrical machinery/equipment: $94.0 billion (38.1% of total exports)

- Footwear: $19.9 billion (8%)

- Machinery, including computers: $14.6 billion (5.9%)

- Clothing and accessories (not knit or crochet): $13.8 billion (5.6%)

- Knit or crochet clothing and accessories: $13.0 billion (5.3%)

- Furniture, bedding, lighting, signs, and prefab buildings: $8.9 billion (3.6%)

- Optical, technical, and medical apparatus: $5.6 billion (2.3%)

- Fish: $5.0 billion (2%)

- Coffee, tea, and spices: $4.6 billion (1.9%)

- Leather/animal gut articles: $4.0 billion (1.6%)

Total Value: $183.4 billion

India’s top 10 exports in 2017-2018 (US dollars):

- Pearls, semiprecious stones, precious metals, jewelry and coins : $41.7 billion (13.8% of total exports)

- Mineral fuels, mineral oils and products of their distillation, bituminous substances and mineral waxes: $38.4 billion (12.7%)

- Nuclear reactors, boilers, machinery and mechanical appliances: $17.9 billion (5.9%)

- Vehicles other than railway or tramway rolling stock, and parts and accessories: $17.2 billion (5.7%)

- Organic chemicals: $14.8 billion (4.9%)

- Pharmaceutical products: $13.2 billion (4.4%)

- Iron and steel: $11.2 billion (3.7%)

- Electrical machinery and equipment, sound recorders and reproducers, television image and sound recorders and reproducers: $9.3 billion (3.1%)

- Articles of apparel and clothing accessories, not knitted or crocheted: $8.7 billion (2.9%)

- Cereals: $8.1 billion (2.7%)

Total Value: $180.5 billion

Mexico’s top 10 exports in 2018 (US dollars):

- Vehicles: $115.5 billion (25.6% of total exports)

- Electrical machinery and equipment: $81.9 billion (18.2%)

- Machinery including computers: $75.4 billion (16.7%)

- Mineral fuels, including oil: $29.7 billion (6.6%)

- Optical, technical, and medical apparatus: $19 billion (4.2%)

- Furniture, bedding, lighting, signs, and prefab buildings: $10.6 billion (2.4%)

- Plastics, and plastic articles: $9.5 billion (2.1%)

- Vegetables: $7.2 billion (1.6%)

- Articles of iron or steel: $6.7 billion (1.5%)

- Gems, and precious metals: $6.7 billion (1.5%)

Total Value: $362.2 billion

But keep in mind, there are disadvantages to sourcing away from China.

Lower productivity.

One major disadvantage sellers often encounter when working with suppliers from Vietnam, India, and other lower-cost countries is lower productivity. Not only are most workers in these countries less experienced and skilled as Chinese workers, their work schedules are shorter as well.

This lower productivity means longer production times, potential problems with quality, and unexpected delays.

Soft skills.

In terms of soft skills and worker attitudes, supply chain experts tell me that when they’ve worked with factories in India and Vietnam, the manufacturers’ approach was more lackadaisical than those in China.

There was no sense of urgency.

For example, while one business owner working with a vendor in Vietnam said that his contacts are very polite, he has to follow up aggressively to ensure deadlines are met. This is because his supplier from Vietnam is less attentive and less responsive than most suppliers from China.

And, in addition to the lax approach of some manufacturers, several supply chain experts have said that dishonesty is a major problem in countries like India.

They claim that a number of factory representatives have lied to them more than one might expect when working with Chinese factories.

Supply chains.

A further disadvantage of shifting one’s manufacturer is that some of the alternatives’ supply chains aren’t as developed and complete as China’s. This complicates things.

For instance, when sourcing textiles, certain raw materials may not be available in Vietnam. In a case like that, the factory would have to source these raw materials elsewhere. They would then have to have them shipped to Vietnam in order to complete the finished product.

This obviously leads to a longer lead time.

Furthermore, when the product’s completion is contingent on importing raw materials from a third country, the risk of other issues occurring increases.

Your supply chain is only as strong as its weakest link. So, when another component is added to that chain, there are more chances for failure and delays.

Logistics.

Finally, it’s important to consider logistics.

In terms of shipping times, ocean freight from Eastern India to the US often takes two weeks longer than it would if shipped from China. It’s also more difficult to coordinate a consolidated shipment from several vendors when shipping from India.

And according to one supply chain expert, Chinese logistics run like a well-oiled machine compared to the logistics in India.

He claims that after a container filled with his product left the Indian factory and was sent to the port, it disappeared. It was several days before they were able to track it down. I’ve even heard horror stories of containers being lost in India, never to be found.

Labor cost comparison.

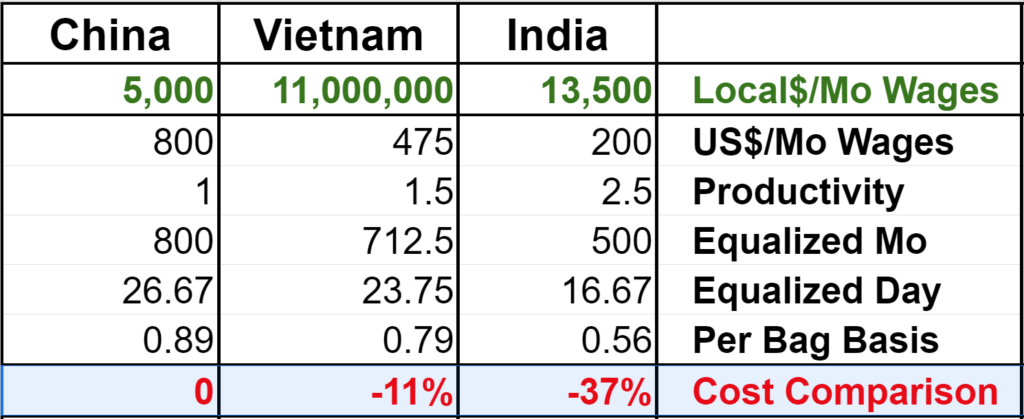

Dan Krassenstein, Global Supply Chain Director at Procon Pacific, shared the following chart from a survey taken in 2018.

*Labor Cost Comparison Between China, Vietnam, and India

Rather than fixating on the specific figures in the above-chart however, Krassenstein recommends that sellers focus on how wages, productivity, and exchange rates can affect overall costs when sourcing a product from China versus Vietnam and India.

Taking everything into account, when compared to China, sourcing the bags from Vietnam resulted in an 11% cost savings. Sourcing from India netted a cost savings of 37%.

Obviously mileage will vary depending on the nature of your products, your suppliers, and location of your supply chain, so your cost savings may not match those in the chart.

How can you find alternative suppliers?

Sourcing suppliers from India, Vietnam, and Mexico isn’t always straightforward. At this point, there isn’t a dominant online-resource for searching for suppliers from these countries. For that reason, I would divide the search between online and offline sources.

Online search:

Even though it’s more difficult to find suppliers outside of China using Alibaba and Global Sources, I still recommend checking out those sites. It will help get the ball rolling on the search for a manufacturer.

And Jungle Scout has a tool that makes finding a supplier outside of China very easy. Their Supplier Database can match you with manufacturers outside of China based on your product needs, along with verification that the supplier has export experience.

Offline search:

Attending trade shows is another way to locate suppliers from other countries. If possible, go to trade shows in Mexico, India and Vietnam, or in your home country if you live in the US, or somewhere in the EU.

It’s also a good idea to visit major international trade fairs, such as the Canton Fair.

To find trade fairs relevant to your search for a supplier, run a google search for shows focused on either your product category, the country you’re considering sourcing from, or both.

Best practices when prequalifying suppliers quickly.

Experience exporting to the US or the EU.

The same quick test that holds true for selecting Chinese suppliers also holds true for selecting suppliers from Vietnam, India, Mexico, and other regions.

The key is to select suppliers that already have experience exporting to a seller’s preferred marketplace.

If a supplier doesn’t have experience manufacturing for the US or the EU, then the quality of their products can be vastly inferior to other suppliers that do have that experience. That’s because many factories in developing countries have much lower standards when producing items for their own country (or other developing countries).

Without that expertise, the supplier may have to drastically improve their product quality, which can be difficult.

On the other hand, if they have exported to the US and/or the EU–and you can validate that claim–then the manufacturer is more likely to meet a seller’s standards.

This test isn’t 100% foolproof, but it’s an 80/20 tactic that I use regularly. And as I mentioned earlier, with Jungle Scout’s Supplier Database, verification of a supplier’s claims is easy.

Sample and inspect.

Next, because lower productivity rates and products with potentially lower quality can be expected when sourcing outside of China, it’s important to ask for samples before signing any contracts.

It’s also a good idea to inspect the factory itself.

I recommend using a third-party quality control service to check product quality. They can also be your eyes and ears on the ground, letting you know if the workshop is up to code.

Consider using a sourcing partner.

If you’re having trouble identifying a supplier, a sourcing partner or agent can help you find manufacturers that are a good fit for your product. They can also aid in negotiations, not to mention bridging the gap between differing business cultures.

Conclusion

In summary, as costs of importing products from China continue to rise, it makes sense to diversify and source away from China. However, it’s important to remember that the savings may not be as drastic as you might expect.

When you factor in the lower productivity, longer delivery times, potential issues around product quality, and possible theft, the savings could be minimal.

So, as a general rule, if you decide to source away from China, focus on products that are less time-sensitive and more price-sensitive first.

For a summary of the best practices covered in this article and more info about sourcing away from China please visit: https://www.8020sourcing.com/sourcingawayfromchina/