Blog: The Million Dollar Case Study Session #10: Tax and Legal Structure For Amazon Sellers

The Million Dollar Case Study Session #10: Tax and Legal Structure For Amazon Sellers

The latest session of the Million Dollar Case Study started off with some exciting and inspiring news:

Jungle Scout will be partnering with Pencils of Promise in the Million Dollar Case Study: 100% of profits for products sold during the Million Dollar Case Study will go towards building schools and providing better education for children around the world.

You can learn more about the program here: Jungle Scout partners with Pencils of Promise.

And also exciting moves, moving closer towards generating some actual sales, we have the first production run of our baby hooded towels completed! I received a package with the samples this week, which you can see here:

Tax & Legal Structure

And now on to the nuts and bolts of starting an Amazon business: the question of tax and legal structure for Amazon sellers.

To help us navigate the topic, we have Stewart Patton, US tax attorney and expat entrepreneur and Founder of U.S. Tax Services. Stewart’s particular expertise is in helping US citizens who live or invest outside of the States understand and optimize their tax situations.

Stewart did a fantastic job in this webinar of addressing the various tax and legal situations of people with varying circumstances, of different citizenships living in and outside of the United States.

Here is a full recap of the webinar:

And the slides can be found here:

The Requisite Disclaimer

As with any legal advise distributed on the web, you certainly can use this as one data point. However, you will also want to get your own legal advice tailored to your particular situation.

Stewart offers an important fact that everyone may want to take heed to… If you are selling products on Amazon as a sole proprietor, without any legal formation protecting you (like an Limited Liability Company or Corporation), you are leaving yourself personally liable if a customer has any issue with a product that you sell on Amazon.

This means that, knock on wood, if a customer has a problem with your product, they could sue you and your personal assets would be unprotected. However, by forming a Limited Liability Company (or S Corp), you would have legal protection and are not personally liable for any mishaps with your product.

Types of Amazon sellers

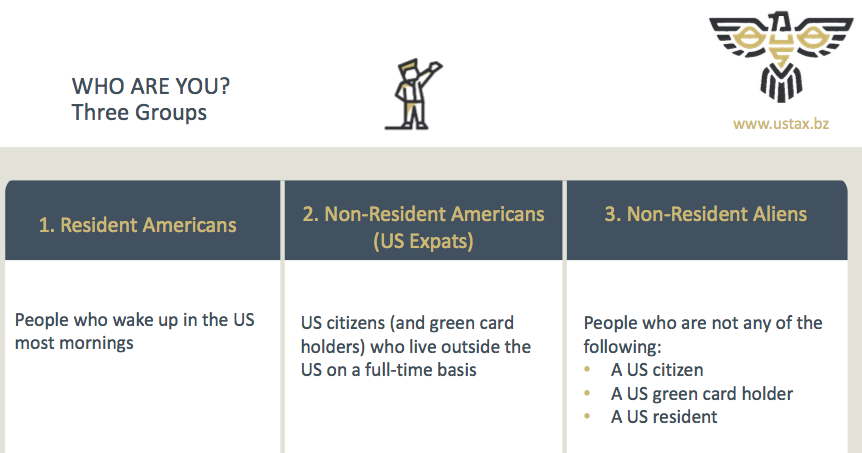

Stewart framed his presentation around three types of Amazon sellers:

- Resident Americans

- People who wake up in the US

- Also, people who spend 6 months in the US, some outside of US

- Non-resident Americans

- US Expats

- US Citizens and green card holders who live outside the US on a full-time basis

- Non-Resident Aliens

- Everyone who is not a US Citizen, a US Green card holder, a US Resident

Types of Legal Formations

Here is a quick overview of the types of Legal Formations that Stewart covers, and recommends:

The Limited Liability Company:

The Limited Liability Company, known as an LLC, is a corporate structure formed under the laws of individual US states. An LLC is owned by its “Members”, and operated by its “Managers”. As noted above, the Members who own the LLC cannot be held personally liable for the company's debts or liabilities. Legally, the LLC has similarities to Corporations, except in regards to how taxes flow through to the owners of the company.

The S Corporation:

S Corporations, as defined by the IRS, “are business corporations that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.” The S Corporation has some tax benefits to business owners, in addition to the legal protection it offers.

Granted, these definitions are very high level, and don’t delve into the details of why each legal entity may make sense for you, depending on your situation.

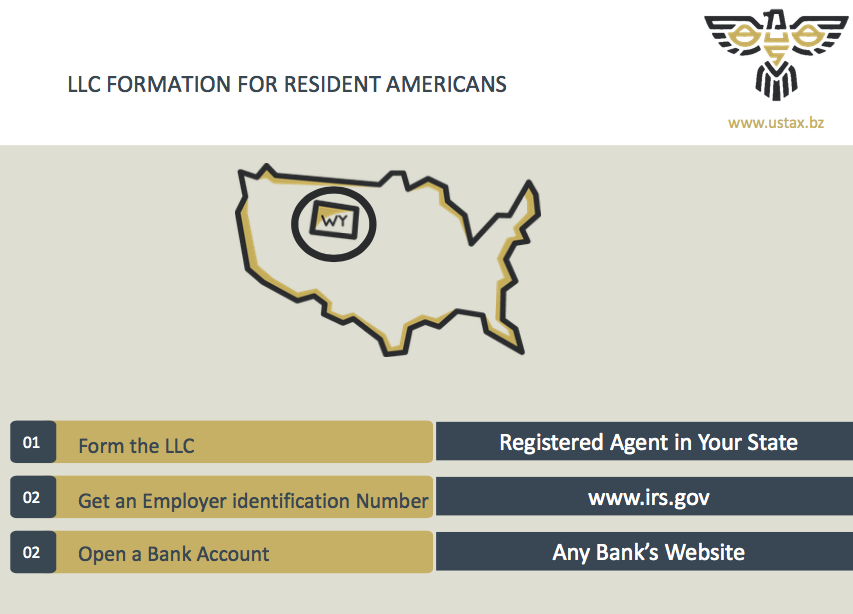

The best legal structure for resident Americans for the LLCs

The easiest and best legal structure if you are an American resident living in the US is a Limited Liability Company, or LLC.

If you are the only person running the business, you can be a single-member LLC. When this is the case, then there is no separate tax regulations you need to follow, the income and deductions appear on your tax filings as your personal income.

If you have multiple members in your LLC, you can elect to file with the IRS as an S Corporation. One stipulation with this is that you have to file a tax return as a company, whereas with a single-member LLC you can file as an individual.

Tax aspects of being self-employed

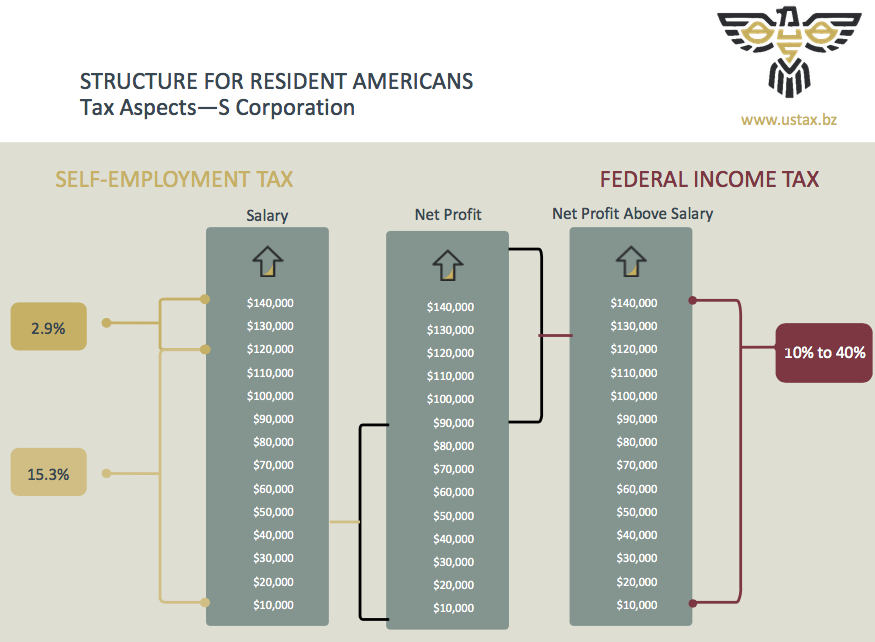

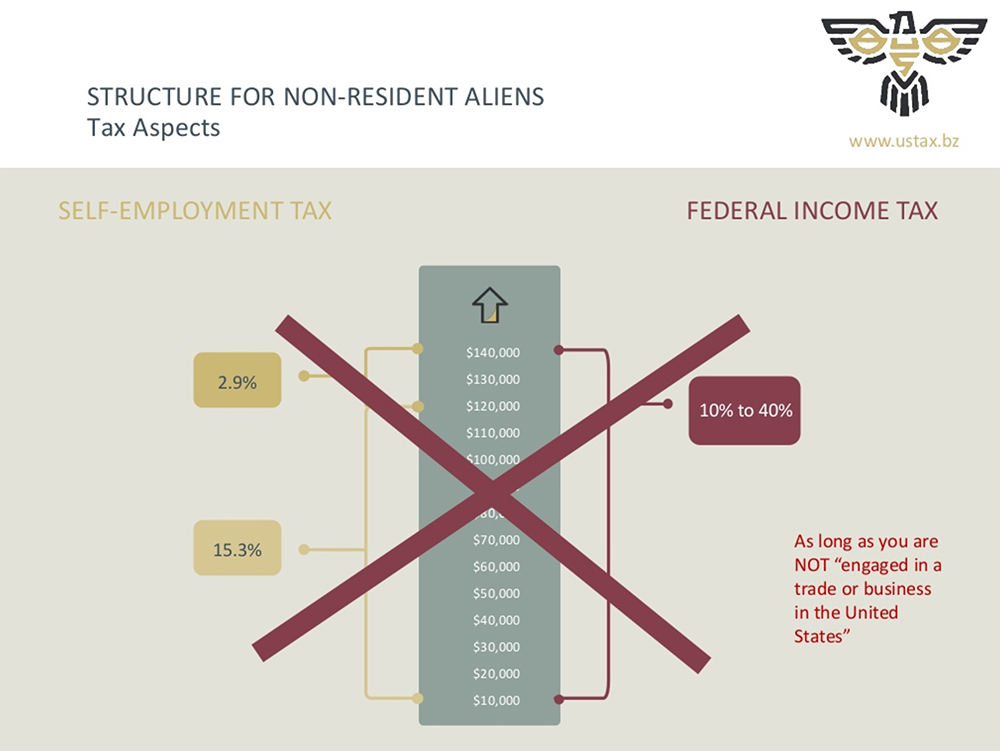

If you are self-employed, and you are the sole member of the LLC, or you have multiple members in the LLC and don’t file your taxes as an S Corporation, you are responsible for self-employment taxes.

If you pay a self-employment tax, it is 15.3% up to $118k, then 2.9% for all taxable income above that. Only the salary portion of your net profit is subject to employment tax, and the net profit above that $118k is subject to federal income tax. Therefore, you can save on some self-employment tax if you file as an S Corp, which is one of the benefits of a multi-member LLC.

This graph can help explain how the tax depends on your tax filing, but of course Stewart does a great job of clearly explaining this in the webinar:

There are going to be different tax regulations when making the decision to file as an S Corporation or LLC, depending on what state you are filing in. In addition, there are some payroll forms and other paperwork when filing these corporate tax forms. All of this leads to one clear conclusion: it’s easiest to get some guidance and help from a CPA! The nuances, details and unique circumstances of each company are complicated enough where a professional is the best solution.

Best legal structure for non-resident Americans

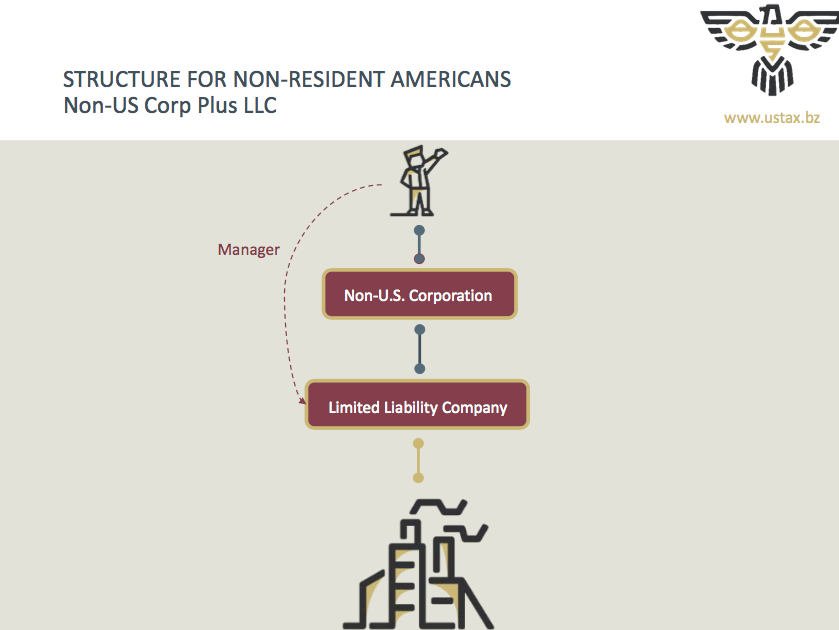

One of the interesting things Americans living outside of the United States is that there are different benefits to various legal structures, depending on whether you are approaching it from a legal/tax perspective or operational perspective.

If you are an American living outside of the United States, everything operationally runs through the LLC. So this includes your Amazon seller account, your bank account where money runs through, domain names, employment contracts, and everything else related to your business runs through the LLC.

However, from tax perspective, it is a single member Non-US Corporation for US Tax purposes. Here is the slide that Stewart used to illustrate the point:

There was an interesting tax benefit to digital nomads and Amazon sellers who are American by citizenship, yet spend significant parts of the year outside of the United States: the Foreign Earned Income Tax Exclusion.

Foreign Earned Income Tax Exclusion allows you to make up to $100,000 from providing personal services. This applies if you are outside of the United States for 11 months of a year.

However, the benefits of this tax break are tempered somewhat for Amazon sellers. Enter the IRS cites the “30% Rule”. This only treats 30% of the Amazon FBA income for your personal services, so ultimately you are required to pay taxes on 70%.

The rationale is that your Amazon FBA business is earned on your time and also your investment. Therefore 30% of the income is for your personal services (which gets the benefit of the Foreign Earned Income Tax Exclusion). The remaining 70% is taxable as US business.

Best tax structure for non-resident Aliens

As you hopefully know by now, non-resident and non-US citizens can still take advantage of selling on the Amazon US store.

The one snag is that if you don’t have a US bank account, Amazon will pay you in the currency of your residency. This means you may have to go through multiple currency conversions.

The benefit to creating an LLC is that it opens the door to create a US bank account. Furthermore, you would get the important liability protection of creating a legal entity.

A small caveat is not to employ too many workers in the United States as a non US citizen and non-resident. Once you start employing people and doing substantial business activity in the US, you open yourself up to more potential taxes.

If you are a non-resident Alien selling on Amazon.com and NOT engaged in trade or business in the US (like employing workers), then you will not be required to file US tax returns. In most circumstances, you will be required to pay tax on your Amazon income in the country where you are tax registered.

So What Now?

If you are an Amazon seller, the first and most important takeaway is simple: get a legal entity formed! It is a quick and relatively cheap process. Ultimately it provides important insurance in case something were to occur with a product that you are selling. If you don't create a legal entity, you leave yourself personally liable for any potential legal issues that could arise.

There are three simple steps:

- Form An LLC

- Get an Employer Identification Number

- Open a Bank Account

Join the next session!

If you are not already registered to join the live Million Dollar Case Study webinars, CLICK HERE TO REGISTER NOW.

Next week on Wednesday, May 3rd at 8p ET/5p PT Greg will be joined by Kym Ellis of the Jungle Scout team to put together an optimized Amazon listing. They will review the process of finding the most important keywords, crafting a listing that attracts visitors and converts customers, and ultimately lay the ground work for moving this project towards our revenue goal!

Can't wait to see you there!